Auditing is the evaluation of the financial accounts by a qualified accountant. A properly conducted audit adds value to a customer’s business. This is essential to gain a fair perspective on the company’s financial statements. With HBC we are not just about making sure the numbers add up, with our auditor’s experience in internal and external audit through hard work and specialist advice for both public and private organization, you know you’ll receive a persistently superior quality audit and having a business partner who can help you take over and improve your operations.

What is Internal Auditing?

Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.

Who are the internal auditors?

An internal auditor (IA) is a trained professional employed by companies to provide independent and objective evaluations of financial and operational business activities, including corporate governance. They are tasked with ensuring that companies comply with laws and regulations, follow proper procedures, and function as efficiently as possible.

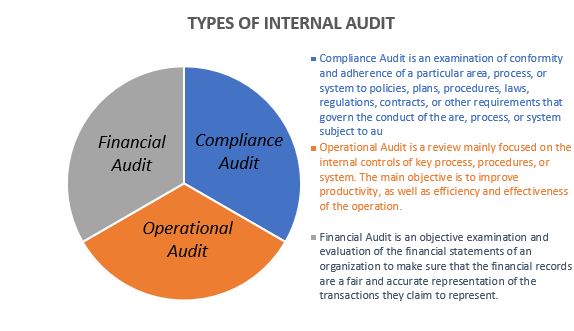

There are three types of Internal Audits:

- Compliance Audit – A compliance audit is an examination of conformity and adherence of a particular area, process, or system to policies, plans, procedures, laws, regulations, contracts, or other requirements that govern the conduct of the area, process, or system subject to audit.

- Operational Audit – An operational audit is a review mainly focused on the internal controls of key processes, procedures, or systems. The main objective is to improve productivity, as well as efficiency and effectiveness of the operation.

- Financial Audit – A financial audit is an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of the transactions they claim to represent.

Advantage of Internal Audit

- Strong Internal Controls – Evaluating your enterprise’s control environment is your internal auditor’s number-one task. Internal audits evaluate your internal controls, which comprise actions, systems, and processes.

- Efficiency – Internal audits spot redundancies in your business practices and procedure and your governance processes and come with recommendations on how to streamline, saving time and money.

- Security – Internal audits scrutinize your cybersecurity environment, counting all your digital devices, for instance, and examining whether they are secured in line with your policies.

- Integrity – People aren’t always honest that’s why Internal audits analyze and scrutinize your financial statements and verify their accuracy and integrity.

- Reduced Risk – Internal audits consider all the identified risks to your enterprise and analyze whether your risk mitigations are working as they should. Where they aren’t, audit reports will tell you what you need to do to resolve the issue.

- Improved Compliance – Internal audits check the laws, regulations, and industry standards with which your organization needs to comply and determine whether you are, in fact, compliant. Where you miss the mark, auditors recommend how to remedy the problem.

DIFFERENCE OF INTERNAL AUDIT TO EXTERNAL AUDIT

The purpose of internal audit is to analyze and improve organizational controls and performance, while, the purpose of external audit is to express an opinion on the organization’s financial condition and financial reporting risks.

What is External Auditing?

Termed as the independent examination of the financial records which is likewise being prepared by an organization, it is the external audit. External audit, also known as the statutory financial audit, aims to check and verify the accuracy of statements and an organization’s financial standing. Through external audit, the financial statements being prepared is similarly check whether it is done in accordance with the set laws and accounting standards. It is an independent examination of the financial records prepared by an external auditor.

Who are the external auditors?

An external auditor is a professional, and independent third party who is not actually part of the organization being audited. They perform an unbiased review of the financial records of an organization. The organization’s accounts and financial statements are similarly being examined by an external auditor. They have the access in the accounting books, payroll, purchasing records and other financial reports of the company to see its weakest points or any of its irregularities and where the strategy for efficiency or improvement can be directly utilize and recommended in the company.

External Auditor are a correspondingly accountable of the following:

- Meeting the organization’s staff to gather information

- Formulating strategies in audit procedures

- Implementing the audit procedures

- Spotting all the existing risks of an organization

- Evaluating the financial report of an organization

- Preparing the final audit report

- Reviewing the final results of the audit report with the clients

Advantage of External Audit

- Comprehensive Report – The demonstration of the overall operation of the company is being presented in an external audit report. The external auditor similarly makes sure that the accuracy of the information in the books of accounts is inevitable.

- Identifies the weaknesses of the organization – An external auditor works on the overall systems and controls environment of the organization. Through external audit, the weaknesses inside the organization, specifically in the accounting systems are being recognized.

- Conforms with the law – The external auditor works on the books of accounts of an organization, making sure that they are obeying the rules and regulations of the concerned authority. Similarly, they will make sure that the accountants of the company are updated with the same rules and regulations of the concerned authority and of the government.

- Saves time and resources – With the help of the external audit report, the indisposition of an organization can be simply detected and through this, it will be way easier to locate where specifically the improvement of work is needed to be done. Because of this, there would be fewer chances of wastage of time and resources.

- Unbiased – Since an external auditor is an independent third party who has no direct relationship to any one inside the organization being audited, certainly, the audit report will be neutral or unbiased.