For any start-up or existing entrepreneur, a business plan supports you in gaining a better understanding of the industry your business will operate in, the competition and any capital requirements to start or operate a business successfully. HBC gives complete supervision assistance and advice with your company set up requirements.

- MAINLAND Company Formation

- FREEZONE Company Formation

- OFFSHORE Company Formation

MAINLAND vs. FREEZONE vs. OFFSHORE

Mainland

Free Zone

Offshore

Ownership

If an expat establishes a company in mainland, they will acquire 49% of share and the rest of 51% share must be acquired by a “Local Sponsor”

An expat /foreign has a full or 100% ownership of the entity. Local sponsor nor service agent is needed to start up a company

An expat /foreign has a full or 100% ownership of the entity until and unless it is located outside UAE. An offshore company cannot have a physical presence in UAE

Office Space

A minimum of 200 sq. ft physical office space is required

Physical office is not required, a free zone company can operate without an office or can have virtual office only

They cannot have any physical office inside UAE. They can have it outside UAE

Business Scope

A company present in the mainland is free to do business anywhere in the UAE such as in the local market and even in Free zone Areas

Unlike the mainland, a free zone company is not normally allowed to do business outside the Free Zone area

They are free to do business outside UAE but restricted to operate inside UAE

Audit

It is a mandatory for a mainland companies to prepare an audit every financial year

Not all FZ companies are required to auditing but most of the FZ authorities they required an audit every financial year

Offshore company is not required at all. They can have one if they want to be financially updated

Visa

A residence visa is given upon the size of the office /work premises

A residence visa is given upon the size of the office / work premises

Since there’s no need for office space, they don’t issue a residence visa

Capital Requirement

Minimum capital vary depends on the legal form of business

A FZ company has a minimum capital depends on the emirate it belongs to

An offshore company in UAE has no minimum requirement

Gov’t Authorities for company set-up

They are under DED (Department of Economic Development), MIL (Ministry of Labor), MOI (Ministry of Interior) etc

FZ have their own / independent FZ Authorities. There are around 40 FZ in UAE

RAKICC (UAE) JAFZA (UAE) and CAYMAN Enterprise City (International) offer offshore formation. The FZ authorities of that jurisdiction look after their approval

MAINLAND Company Formation

The task of setting up a mainland business in Dubai can seem confusing, time-consuming, and expensive. HBC ‘s goal is to make the process as simple as possible, and we always start with a thorough understanding of your needs. Given the number of free zones in the UAE advertising their services locally and abroad, there is often confusion as to the need to set up a business in mainland at all.

A simple rule of thumb is that if your business will trade in physical goods in Dubai then you will need a mainland license. This also includes local construction, manufacturing, and related activities. Furthermore many service companies may require mainland registration if they plan to work with government departments. There are exceptions, and a member of our team will discuss your individual requirements to determine what options are available to you.

All mainland companies licensed through the Department of Economic Development (DED) in Dubai are required to rent physical office space as part of the licensing requirements. All offices at HBC Business Centers are eligible for business license registration and meet the requirements of the various government departments involved.

Three types of Mainland Company Formation

COMMERCIAL LICENSE

CIVIL COMPANY

SOLE ESTABLISHMENT

This company type is the most common type of registration in the UAE and is recommended, where the purpose of the entity is to trade within the whole UAE. Please note that 100% foreign ownership of this company type in the UAE is not allowed.

Please note:

-51% of shares must belong to one or more UAE Nationals also known as “Local Sponsor”

-Foreign investors are allowed to hold up to 49% shares in UAE companies

-100% corporate tax exemption

-Different business -related activities are permitted in one trade license

This type of company is a 100% owned by foreign ownership with up to 3 shareholders and a local service agent. It is applicable for service and professional activities/licenses.

Please note:

-Local service agent owns 0% of business shares nor profit, means a foreign partner owns 100% of business shares and profit

-Local service agent role is to provide their signature for the completion of government related task

-Local service agent has no administrative rights to the company and is only entitled for government services annual payment

This type of entities applies to professional, consultancy and service activities. It is the best way for a foreign investor to get a 100% owner in UAE company registered outside Free Zone.

Please note:

-100% foreign ownership

-do not require any form of local ownership

-The local will act as an agent only

-No minimum capital requirement

-One shareholder is applicable

-100% corporate tax exemption

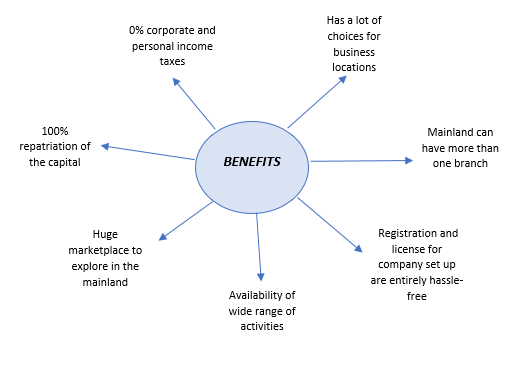

Here are the benefits to enjoy

Start your Mainland Company Today

We have years of experience in establishing businesses all over the UAE. With our level of knowledge and expertise team, you are guaranteed to get best advice in UAE! We can facilitate a fast, cost-effective, smooth business, trade, and industry licenses with hassle free. Our relationship does not end once we have completed the company formation on your behalf. In fact, it is just the beginning and we go far beyond simply providing PRO services and support. We pride ourselves in the fact that many clients have retained our services for many years now, and continue to do so even after they move out of our serviced offices. This is testament to our team and the dedication towards customer service that is an integral part of the HBC ethos.

FREEZONE COMPANY FORMATION

A free zone company is a company formed within a special jurisdiction that comes under a particular Emirate. As of now, over 40 Free Zones operating in the UAE as a whole. Free zone jurisdictions have their own regulations and have a government regulatory body called the Free Zone Authority. The Free zone Authority is in charge of trade license issuance. A UAE free zone is characterized by the benefits of 100% foreign ownership and tax concessions. A free zone company is authorized to trade only within the free zone and outside the UAE.

Registering a Free Zone company in UAE will benefit your business in such way

- No personal income or capital gain taxes

- 100% company foreign ownership

- No corporate taxes

- No currency restrictions.

- Easy company registration and business setup services

- Liberal labor laws and no recruitment problems

- Excellent support and business services

- No duties on import and export

- 100% repatriation of capital and profits

- Modern efficient communications

- More than 40 Free Zones all over UAE

Start your Free Zone Company Today!

We have years of experience in establishing businesses all over the UAE. With our level of knowledge and expertise team, you are guaranteed to get best advice in UAE! We can facilitate a fast, cost-effective, smooth business, trade, and industry licenses with hassle free. Our relationship does not end once we have completed the company formation on your behalf. In fact, it is just the beginning and we go far beyond simply providing PRO services and support. We pride ourselves in the fact that many clients have retained our services for many years now, and continue to do so even after they move out of our serviced offices. This is testament to our team and the dedication towards customer service that is an integral part of the HBC ethos.

OFFSHORE COMPANY FORMATION

An Offshore company formation is fundamentally used for the minimization of taxation, protection of assets purposes, International Business Company (typically known as an Offshore Company) became the most attractive corporate structure for foreign investors. Offshore company setup is the mechanism of the first choice for the financial privacy, zero bureaucracy, low cost, security and property rights and foreign investments. Offshore company registration in the UAE provides you with the real opportunity legally to raise profitability of your business, simplified reporting system, anonymity and confidentiality.

As an active registered agent of an Offshore Authorities, House of Business City Account Services will provide you the best solution to set up a new offshore company to optimize your business.

Advantages:

- No Corporate taxes

- 100% company foreign ownership

- No personal or capital gain taxes

- 100% repatriation of capital and profits

- No minimum capital requirement

- Audit Report is not mandatory

- No restrictions on the director’s/shareholder’s residency or citizenship

- Low cost of company set-up and easy and quick registration

- No public registry published

- Personal presence is not required for company incorporation

Start your Free Zone Company Today

We have years of experience in establishing businesses all over the UAE. With our level of knowledge and expertise team, you are guaranteed to get best advice in UAE! We can facilitate a fast, cost-effective, smooth business, trade, and industry licenses with hassle free. Our relationship does not end once we have completed the company formation on your behalf. In fact, it is just the beginning and we go far beyond simply providing PRO services and support. We pride ourselves in the fact that many clients have retained our services for many years now, and continue to do so even after they move out of our serviced offices. This is testament to our team and the dedication towards customer service that is an integral part of the HBC ethos.